-

Products

-

Streamline Fleet Operations With Our Electronic Logging Device

Seamless Protection of Drivers via AI Dashcam

Precision Tracking with GPS and Advanced Telematics

Empower Your Fleet's Green Transition With Optimized Efficiency

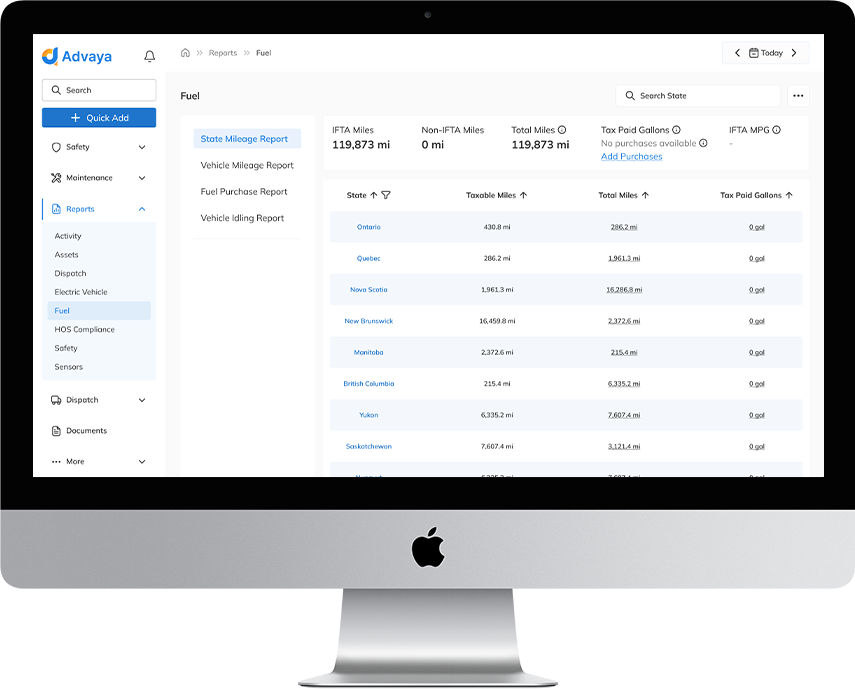

Revolutionize Efficiency with Data Insights

-

-

Solutions

-

Optimize Delivery Excellence by Accelerating Turnaround, Maximizing Trip Frequency, and Reliable Cargo Security

Enhance Safety, and Ensure Seamless Compliance for Optimal Performance in the Energy Sector

Transform Food & Beverage Operations by Enhancing Efficiency, Ensuring Quality, and Preventing Spoilage.

Elevate Efficiency, and Ensure Seamless Journeys for Ultimate Commuter Satisfaction.

-

Ensure Compliance, Enhance Efficiency, and Safeguard Quality in the Distribution of Life-Saving Medications.

Ensure Compliance, Enhance Efficiency, and Safeguard Quality in the Distribution of Life-Saving Medications.

Optimize Routes, and Ensure Timely Deliveries for Seamless Supply Chain Management.

Unlock the Potential of Agricultural Operations, Supercharge Fleet Efficiency, and Skyrocket Productivity.

-

-

Support

-

Get Assistance with Our Fleet Management Solution

-

Company

-

Discover Our Story by Learning about our company's journey, values, and commitment

Reach out to us for any inquiries or assistance

Explore exciting opportunities and become part of our dynamic team

-

Explore insightful blogs for the latest trends and best practices in fleet management

Discover our company's coverage and achievements in the press

-

- Partner With Us